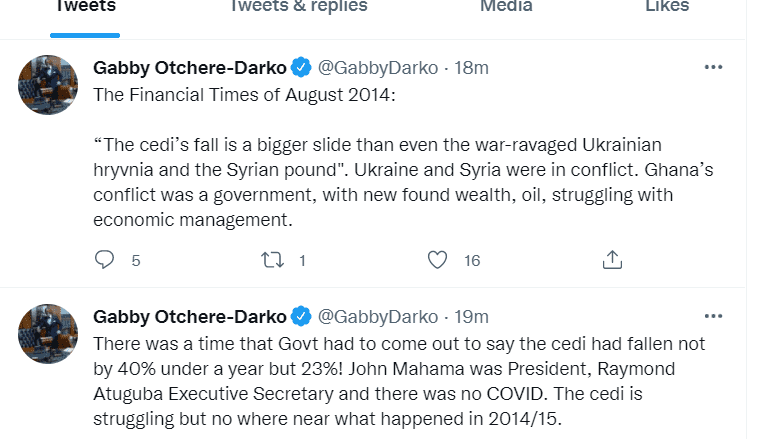

A leading member of the governing New Patriotic Party (NPP), Gabby Otchere Darko has said although the local currency is struggling at the moment, it is nowhere near what happened under former President John Dramani Mahama in 2014.

In a tweet on Wednesday, March 2, the former Executive Director of the Danquah Institute said “There was a time that government had to come out to say the cedi had fallen not by 40% under a year but 23%! John Mahama was President, Raymond Atuguba Executive Secretary and there was no COVID. The cedi is struggling but nowhere near what happened in 2014.”

Meanwhile, an Associate Professor at the University of Ghana Business School (UGBS), Lord Mensah, has asked the government to quickly introduce measures to support the cedi against the major trading currencies, especially the dollar, within the shortest possible time.

This comes after the cedi has been described by Bloomberg as the worst-performing currency among Africa’s top currencies.

“There will be hope but then, that will be within the five years. The dynamics are going to be that any time we will expect that the dollar inflow from the world bank will see stability in the cedi, the cedi will start picking up with the dollar. But the long-term suggestion is still going to be upwards. So I will tell you, there won’t be any hope in the long term but on a short term basis we are going to see that kind of up and downstream within as far as the cedi and dollar relationship is concerned,” he told Alfred Ocansey on the Business Focus on TV3 Monday, February 28.

Bloomberg pitched the depreciation of the local currency to the dollar at 8.86% between January 1, 2022, and February 25, 2022.

This is followed by the Zambian kwacha with a depreciation of 6.02%.

In 2020, the international media and research organization rated the Ghana cedi as the best performing currency in the world against the United States Dollar.

Ghana and the Zambian economies have been battling with fiscal slippages, whilst their rising debts have created fears among investors regarding their economic outlook.

Whereas Zambia agreed to an International Monetary Fund bailout of $1.4 billion in December 2021 for a crucial three-year program to restructure its debt, Ghana is adamant about returning to the Bretton Wood institution for a similar program to build investor credibility.

Crude oil has been selling above $100 per barrel, but the foreign inflows from the commodity have done little to help stabilize the cedi.

However, the five-year $4.5 billion Country Partnership Framework from the World Bank is expected to inject some dollar inflows into the economy and help shore up the value of the cedi.

The Gambian dalasi, New Sudanese pound, and Ethiopian birr are among African Currencies with the “Worst Spot Returns” by Bloomberg.

Angola Kwanza, Namibian dollar, and South Africa are however among African currencies with the “Best Spot Returns”.

Source: 3news.com